05 January 2014, Abuja – Available records show that Nigeria’s mining industry is underdeveloped, contributing only three per cent to the country’s Gross Domestic Product (GDP).

05 January 2014, Abuja – Available records show that Nigeria’s mining industry is underdeveloped, contributing only three per cent to the country’s Gross Domestic Product (GDP).

Observers note that the exploitation of the country’s solid minerals has been largely affected by the discovery of petroleum, as revenues from crude oil soon became the mainstay of the nation’s economy.

They, however, note that successive administrations have been making specific efforts to revitalise the solid minerals sector, considering its importance in national economic development plans.

For instance, the Ministry of Mines and Steel Development recently said that it had formulated a policy to regulate operations in the mining sector in which seven strategic solid minerals were given priority attention.

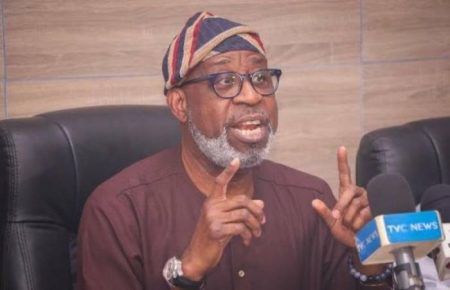

Mr Musa Sada, the Minister of Mines and Steel Development said that the selected solid minerals were gold, coal, bitumen, limestone, iron ore, lead/zinc and barytes.

He said that these minerals had high economic potential that was capable of generating jobs and creating wealth for the people.

Sada said that the seven minerals were chosen out of over 34 identified solid minerals located across the country in view of their strategic importance to the national economy and their quantities.

Mrs Diezani Allison-Madueke, the former Minister of Mines and Steel Development, also spoke on the development plans for the seven minerals.

She stressed that the minerals’ selection was partly due to the fact that they could be found in commercial quantities across the six geopolitical zones of the country.

Owing to the minerals’ distribution pattern, Malam Goni Sheikh, the former Director of Nigeria’s Mining Cadastre Office, stressed that structured and efficient exploitation of the minerals would contribute significantly to national development efforts.

He said that with the Mineral and Mining Act of 2007, the Federal Government was poised to restore the confidence of foreign investors in the mining industry by introducing fresh incentives and institutional policy changes.

Unfolding the Federal Government’s plans to transform the sector, President Goodluck Jonathan recently expressed the government’s intention to develop mining activities, as part of strategies to diversify Nigeria’s mono-product economy.

He stressed that the government’s commitment towards the development of solid minerals was evident in its design of a roadmap for the transformation of the solid minerals sector.

According to him, the highlights of the roadmap include increasing the sector’s contribution to the GDP from three per cent to five per cent by 2015 and 10 per cent by 2020.

Jonathan observed that Nigeria’s coal deposits alone had the potential of generating more than 30 per cent of the nation’s electricity needs with the development of appropriate technology.

The roadmap notwithstanding, stakeholders underscore the need to put in place some measures in the mining sector so as to stimulate economic growth via the sector.

They note that the foreign investors’ assessment of Nigeria’s mining sector is not inspiring and, therefore, call for the initiation of proactive measures to attract potential foreign investors.

This is because of the not-to-positive views of some international mining experts about the state of Nigeria’s solid minerals sector.

For instance, a South African mining expert, Mr Adam Kendall, said that Nigeria was not a significant player in many of the core global mining commodities.

Kendall said that Nigeria was rated lowest on coal reserve base because of its poor geosciences data on the available minerals in the country.

“Compared to the U.S. with 237,295 metric tonnes, China 114,500 metric tonnes, Australia 76,400 metric tonnes, India 40,699 metric tonnes, Nigeria has only 360 metric tonnes of coal reserve base,’’ he said.

Kendall stressed that for Nigeria to attract investors in its solid minerals sector, the government must have correct geosciences data on the country’s minerals.

He said that the data would include availability and quality of minerals, stressing that Nigeria should also develop appropriate tax structure to reduce the cost of operation.

Kendall said that the country should also develop appropriate legal framework, including clear rules, and a social framework that would reduce level of conflicts between mining firms and their host communities

Nevertheless, analysts say that there are other problems that hinder the development of Nigeria’s solid minerals sector.

They, nonetheless, note that the lack of access to credit for potential investors and paucity of funds for minerals’ development schemes are some of the fundamental factors inhibiting the growth of the mining industry.

All the same, Mr Sunday Iduh of Korea Development Institute School of Public Policy said in a research paper that the extremely low contribution of solid minerals to Nigeria’s GDP “is attributed to the underdevelopment of the mining sector.

“This is due to inadequate and insufficient policies for solid minerals exploration and development,’’ he added.

Iduh particularly underscored the need to develop Nigeria’s solid minerals sector to enable the country to achieve economic growth through foreign direct investment.

He said that the sector had the potential to generate additional internal revenue, while boosting foreign exchange, employment opportunities, capital and technology transfer.

Iduh said that research had shown that with an environment that was conducive to economic growth, good policies, good incentives, good infrastructure and political stability; Nigeria’s mining sector would be transformed.

– Fatima Sule, NAN