23 December 2014, Lagos – Global demand for coal over the next five years will continue marching higher, breaking the 9-billion-tonne level by 2019, the International Energy Agency (IEA) said in its annual Medium-Term Coal Market Report just released.

This is just as Nigeria, with abundant coal reserves spread across Enugu, Kogi, Nasarawa and Gombe states, is yet to fully utilize its deposits.

The Minister of Power, Professor Chinedu Nebo recently said that the federal government is working out a sustainable framework to ensure profitability on future investments in the coal-to-power aspect of Nigeria’s electricity mix.

“We do not have infinite coal deposit, so we have to plan well for utilisation of the deposit that we have, that is why we have to initiate processes to develop a bankable framework for coal-to-power initiative. We want to ensure that we do not start projects that we cannot finish in the coal-to-power aspect of our energy mix,” Nebo said, while addressing a gathering of energy economists at the 7th Annual Nigerian Association for Energy Economists (NAEE)/International Association for Energy Economists (IAEE) conference in Abuja.

The IEA report notes that despite China’s efforts to moderate its coal consumption, it will still account for three-fifths of demand growth during the outlook period. Moreover, China will be joined by India, ASEAN countries and other countries in Asia as the main engines of growth in coal consumption, offsetting declines in Europe and the United States.

“We have heard many pledges and policies aimed at mitigating climate change, but over the next five years they will mostly fail to arrest the growth in coal demand,” IEA Executive Director Maria van der Hoeven said.

“Although the contribution that coal makes to energy security and access to energy is undeniable, I must emphasise once again that coal use in its current form is simply unsustainable. For this to change, we need to radically accelerate deployment of carbon capture and sequestration.”

The Executive Director also called for more investment in high-efficiency coal-fired power plants, especially in emerging economies.

“New plants are being built, in an arc running from South Africa to Southeast Asia, but too many of these are based on decades-old technology,” she said. “Regrettably, they will be burning coal inefficiently for many years to come.”

The report noted that global coal demand growth has been slowing in recent years, and sees that trend continuing. It explained that coal demand will grow at an average rate of 2.1 percent per year through 2019. This compares to the 2013 report’s forecast of 2.3 percent for the five years through 2018 and the actual growth rate of 3.3 percent per year between 2010 and 2013.As has been the case for more than a decade, the fate of the global coal market will be determined by China.

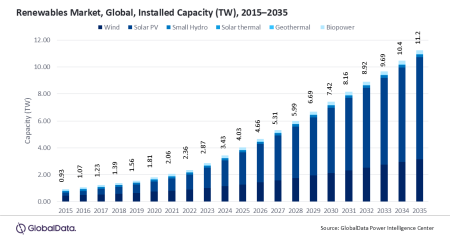

The world’s biggest coal user, producer and importer has embarked on a campaign to diversify its energy supply and reduce its energy intensity, and the resulting increase in gas, nuclear and renewables will be staggering.

However, the IEA report shows that despite these efforts, and under normal macroeconomic circumstances, Chinese coal consumption will not peak during the five-year outlook period.The report’s forecasts come with considerable uncertainties, especially regarding the prospect of new policies affecting coal.

Authorities in China as well as in key markets like Indonesia, Korea, Germany and India, have announced policy changes that could sharply affect coal market fundamentals. The possibility of these policy changes becoming reality is compounding uncertainty resulting from the current economic climate.

The issue of low prices remains a hot topic among coal market participants. Last year’s report emphasised that many coal producers were running at losses, largely driven by take-or-pay infrastructure contracts or financial liabilities.

Coal prices have declined even more since last year, but several factors have helped producers withstand further economic pain.

– Vanguard