22 September 2013, Abuja – The Federal Government is planning a Mining Industry Tax Act to address the revenue challenges in the solid minerals sector, Minister of Mines and Steel Development, Mr. Musa Sada, has said.

22 September 2013, Abuja – The Federal Government is planning a Mining Industry Tax Act to address the revenue challenges in the solid minerals sector, Minister of Mines and Steel Development, Mr. Musa Sada, has said.

Sada said the government would, as part of efforts towards achieving this, be developing a sector-specific fiscal regime that would put the Tax Act in place.

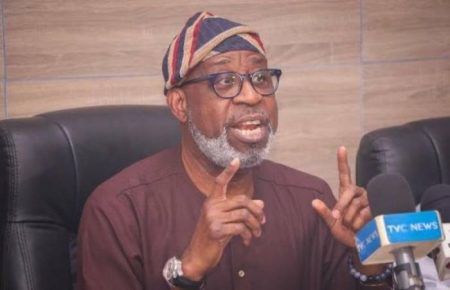

The minister spoke as he urged operators in the mining sector to cooperate with the Nigerian Extractive Industries Transparency Initiative, NEITI, in the generation of relevant data for the 2011 solid minerals sector audit or risk a revocation of their licence.

He explained that the 2007-2010 NEITI audit report helped expose numerous lapses in the sector, adding that this enabled the ministry to strengthen its system by closing up the gaps and improving on revenue collection as well as accountability in tax and royalty regimes.

Warning operators to shun acts that could work against the goals of the planned audit, he revealed that the ministry has commenced collaboration with infrastructure ministries to facilitate proper assessment of revenues.

“It is important that I state here that cooperating with NEITI during this audit period is mandatory otherwise, you will be in default of the Nigerian Minerals and Mining Act, 2007, which is very clear on the declaration of all results of your mining operations.

“The penalty for non-disclosure of required information may include revocation of mining licences, among others,” Sada said at a NEITI workshop for the 2011 solid minerals sector audit in Abuja.

The 2007-2010 NEITI audit revealed an unreconciled N687 million as total aggregate discrepancy in government revenue, which is about 12.5 per cent of the total government receipts over companies’ payments.