28 July 2013, Nairobi — Mining stakeholders have asked the government to look into tax issues that are negatively impacting the sector. They want the government to revoke the withholding tax law as well as zero rating of VAT tax on exploration services.

28 July 2013, Nairobi — Mining stakeholders have asked the government to look into tax issues that are negatively impacting the sector. They want the government to revoke the withholding tax law as well as zero rating of VAT tax on exploration services.

Speaking during a consultative meeting with Mining Cabinet Secretary Najib Balala, the Kenya Chamber of Mines Chairman Adiel Gitari said the country’s mining sector is still under explored and undeveloped compared with other countries in the region. “There is need to enhance current investment as well as encourage new investment instead of introducing a tax on investment,” Gitari said.

He said that the Income Tax Act already deals with the disposal of assets and assignment of rights and therefore there is no need to have the withholding tax on sale proceeds.

Gitari asked for goods and services to mining and mineral prospecting companies to be zero rated for VAT purposes. “Mining and mineral prospecting companies suffer VAT on importation of and purchase of local goods and services and this increases the cost of doing business as such companies take a long time to reach production and sale of minerals,” he said.

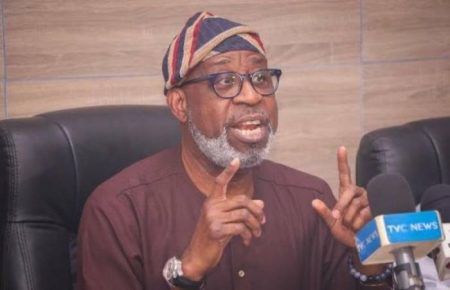

Welcoming the consultative meeting, Balala said that he will look into these issues as the ministry works on creating a strategy for making Kenya a mining hub. “We are also reviewing the process of licensing to make it more effective and ease the process,” Balala said.

He said that the ministry will be holding talks with the Treasury to have a one comprehensive review of the taxation issues that will benefit all stakeholders.

Balala revealed that the Mining Bill is being reviewed in a bid to see all stakeholders benefit from the industry and it will soon be ready to be tabled in Parliament for approval.

He said that the ministry also has plans to build a credible laboratory with international standards. “We are also looking at creating value addition and incentives to lure big investments in the industry,” Balala revealed.