*To add 20,000bopd to national oil output with strategic investments

OpeOluwani AKintayo

Lagos — Indigenous oil and gas firm, Lekoil has explained the reason behind its 2018 financial loss.

In a statement on Wednesday, the firm said Profitability in 2018 was not possible because of the “immense investment that was undertaken within the year, as is common in the oil and gas industry”.

Lekoil’s 2018 financial results showed that it had lost significant ground in terms of profit, compared to 2017 when the young company’s profit stood tall at US$6.5 million.

It, however, indicated that its strategic investments this year could lead to an additional 15,000-20,000bopd increase in national oil production in 2019.

“The priority for 2019 is to grow production volumes at Otakikpo through Phase Two development (subject to funding) to reach gross volumes of 15,000 to 20,000 bopd. The first step has already occurred, with 3D seismic data acquisition and interpretation now completed,” Lekoil’s CEO, Olalekan Akinyanmi said in a note that accompanied its 2018 annual report which was released in late June.

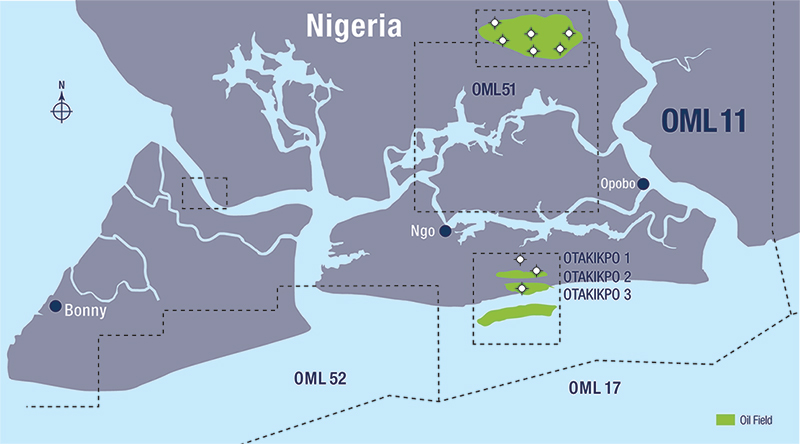

At the Otakikpo field which is sited in a coastal swamp location in oil mining lease (OML) 11, production levels averaged approximately gross 5,345 bopd in 2018 even though LEKOIL only started drilling in the first quarter of 2017. The company is determined to further exploit the asset to the benefit of all stakeholders in the next few years.

“The next year should, therefore, provide key catalysts for value appreciation for shareholders as we move forward in building a leading Africa-focused exploration and production business,” Akinyanmi said in the note.

“We also continue to advance towards- the start of the appraisal drilling programme on Ogo in OPL 310. We will work with our joint-venture partner, Optimum to negotiate agreements that will allow us to make progress on the block, after securing all relevant regulatory extensions and approvals, Mr. Akinyanmi also said in the note.

Lekoil is an Africa focused oil and gas exploration and production company with interests in Nigeria and Namibia. The Company was founded in 2010 by a group of leading professionals with extensive experience in the international upstream oil and gas industry as well as in global fund management and investment banking.