Abuja — Nigeria’s total public debt could rise to 37.1% of its gross domestic product (GDP) this year, close to the government’s self-imposed 40% limit, the country’s Debt Management Office said on Thursday.

The debt office linked the projected rise in the debt-to-GDP ratio from 23.4% in September to new borrowing and a central bank loan-to-bond swap.

“The country’s debt stock remains sustainable under these criteria, but the borrowing space has been reduced when compared to Nigeria’s self-imposed debt limit of 40%,” it said in a report.

Nigeria has said it aims to borrow 8.8 trillion naira ($11.81 billion) in 2023 to cover its budget deficit and has swapped temporary overdrafts worth 23 trillion naira into long-term bonds this year.

The debt office estimates Nigeria’s debt service-to-GDP ratio will reach 73.5% in 2023, exceeding a government limit of 50% due to low revenue collection.

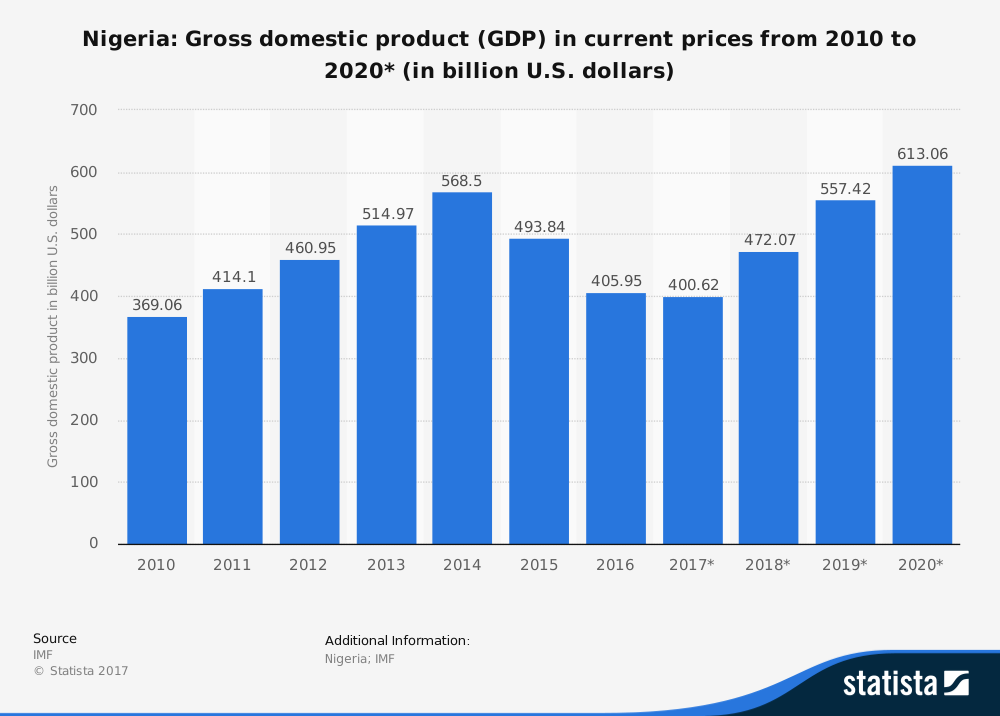

President Bola Tinubu, who took office last month, is embarking on Nigeria’s biggest reform agenda in decades as he seeks to tackle the country’s debt burden, low economic growth, double-digit inflation and mounting insecurity.

Nigeria expects restricted access to international capital markets in the near term after Moody’s downgraded its credit in January, the debt office said, adding it would seek help from development finance institutions, export and international banks to bridge the gap in external financing.

Nigeria’s total public debt was around $103 billion as of September.

($1 = 745.0000 naira)

*Elisha Bala-Gbogbo & Chijioke Ohuocha; Editing: Alexander Winning & Barbara Lewis – Reuters

Follow us on twitter