Oil price steadily rising towards pre-collapse levels

Oil price steadily rising towards pre-collapse levels

06 November 2018, Sweetcrude, Johannesburg, South Africa — The outlook for Africa’s oil & gas industry is positive amid difficult operating and economic headwinds. Tough economic and external conditions have placed pressure on oil & gas companies to be more cost-effective and efficient.

Companies have adapted to a low-cost environment, which promises to be even more beneficial given the current recovering oil price. These are some of the highlights from PwC’s annual Africa Oil & Gas Review released today at the 25th Africa Oil Week conference, 2018 held in Cape Town.

“Africa’s oil & gas companies have weathered the downturns and capitalised on the upswings focusing their efforts on new ways of working, reducing costs and utilising new technology,” Chris Bredenhann PwC Africa Oil & Gas Advisory Leader says.

Companies have taken to restructuring their portfolios with a focus on established regions, less exploration, higher value plays with low break-even-cost, and projects with shorter lead times and lower risk. The industry has also renewed its focus on delivering projects on time and on budget.

As the oil price is steadily rising towards pre-collapse levels, the outlook for the industry is hopeful. “It is, however, important for companies to avoid falling into the cost inflation trap that could eat into the profitability gains that should follow from the rising oil price. Keeping up capital discipline and further improving productivity will yield sustained results for the industry,” Bredenhann adds.

Despite positive developments, the oil & gas industry still faces numerous and persistent challenges around talent shortages, regulatory uncertainty, political instability, corruption and fraud, and a lack of infrastructure.

Notwithstanding the challenges, Africa does offer plenty of opportunities in the form of unexplored hydrocarbon demand fuelled by population growth, urbanisation and the emergence of a growing middle class.

PwC’s Africa Oil & Gas Review, 2018 analyses what has happened in the last 12 months in the oil & gas industry within the major and emerging markets. This edition focuses on the expert opinions of a panel of industry players from across the value chain who share their views of oil & gas in Africa.

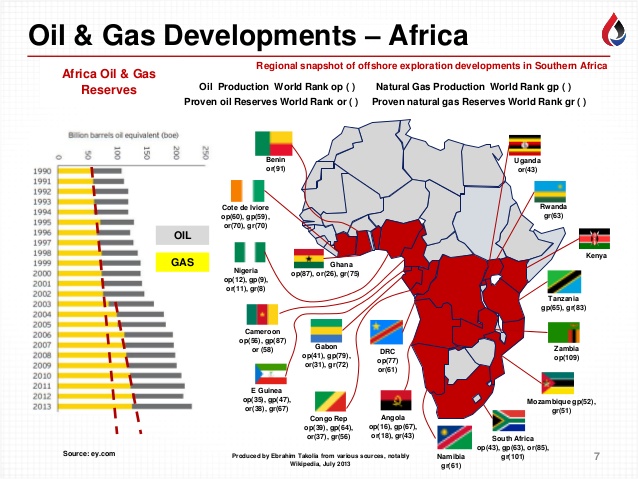

At the end of 2017, Africa is reported to have 487.8 tcf of proven gas reserves, 7.1% of global proven reserves, only marginal changes to the prior year. Africa’s share of global oil production has slightly increased by 0. 3% since last year to 8.7% standing at 8.1 million bbl/d. The main contributors continue to be Nigeria, Angola, Algeria, and Egypt. Libya also increased its production by 102.9% in 2017, placing it as the fourth-largest oil producer in Africa with an 11% share moving Egypt into the fifth position.

Regulatory developments in Africa

Regulatory uncertainty continues to be a major barrier to the development of the oil & gas industry in Africa. Overall, there are some positive developments that demonstrate that governments are reacting to the new environment. Despite some notable improvements around regulation, there is still a high level of uncertainty in a number of jurisdictions.

In South Africa, the proposed Amendment Bill to the Mineral and Petroleum Resources Development Act (MPRDA) may be withdrawn, and there are plans to split oil & gas from mining formulating separate legislation.

Growth and development

The outlook for the oil & gas industry is looking more optimistic with the Brent oil price having broken through the US$80 mark at the time of compiling our report. Although there has been a significant increase in the number and size of final investment decisions (FIDs) in 2018, the industry is not what it was.

New finds are much smaller and leaner than they were in prior years. Deepwater oil has been given preference over gas, and oil fields offering the highest rates of return are attracting investment. There is also a preference for brownfield over greenfield developments.

The current oil price recovery reflects a tight supply and demand balance, as well as an indication that we are heading towards a potential global supply crunch in the early 2020s. Exploration spend in Africa and globally is starting to pick up as well. It is safe to assume that this trend will continue if the current higher price environment is sustained.

Digital disruption in Africa

There have been a number of developments in the digital transformation in the oil & gas industry, not only globally, but also in Africa. A number of new technologies have been deployed by the industry across the value chain. Some examples include the use of drones to inspect remote facilities thereby reducing safety and health risks; the use of robots to undertake monitoring and safety checks, which also reduces the safety risks for human operators; and the use of virtual reality to simulate the drilling of wells remarkably reducing drilling costs. Digital disruption is here to stay, and African companies must embrace this to reap the rewards.

Looking to the future

Africa is the world’s fastest economic region with a growing population that is becoming more urbanised. According to PwC’s Strategy & estimates, Africa’s total energy demand is forecast to increase by 60% to 28 000 trillion btu by 2030.

Based on different potential trajectories for economic development, energy access policy and climate mitigation strategies, researchers have put forward various alternative scenarios for energy production and consumption on the continent in the years ahead.

Hydrocarbons are expected to continue to play a major role in the energy mix that will satisfy Africa’s growing energy needs. Major gas resources on the continent including Mozambique, Nigeria, Angola, Tanzania, Senegal, and Mauritania, could augment the key position of gas as an energy source for Africans. In the low-carbon context, gas also plays the role of a transition fuel before a wider switch to renewables, a development which is likely to take longer in Africa than on other continents.

The increase in population and the demand for freight transport will also see an increased demand for liquid fuels. Many African countries are ‘thinking refineries’ at various scales. Countries that are considering new refineries or upgrades include Angola, Equatorial Guinea, Uganda, Nigeria, Republic of Congo, Ghana, São Tomé & Príncipe, and Zambia. Given projected population growth and refined fuels consumption, an estimated additional 3.4 bbl/d of refined fuels will be needed to meet Africa’s needs by 2030.

The role of National Oil Companies (NOCs)

The role that NOCs play as operators and custodians of the orderly development of the hydrocarbon industry in their respective countries cannot be underestimated. Almost 30 of Africa’s NOCs are involved at various points of the value chain and at different levels of maturity.

Our analysis delves deeper into the NOC landscape to provide a perspective on the future that NOCs could face. We have identified four potential scenarios along two axes: the level of regulatory stability and the level of diversification within a country’s economy.

These scenarios depict a number of possible future pathways and provide industry players with some options with regard to how they might respond to these potential outcomes and their impact on operations.

NOCs should consider these scenarios to enable them to design strategies that avoid the pitfalls identified.

The African oil & gas industry has been through some difficult years in the wake of the oil price crash. However, the industry has restructured itself and is more competitively placed in terms of operational performance.

“It is critical that the sector retains its capital discipline and adopts digital technologies if the hard-earned wins in cost savings are to be retained. Progress in addressing corruption and improving corporate governance will also need to be maintained. Moreover, in the longer term, the energy transition will continue to impact the sector’s dynamics with implications for oil demand,” Bredenhann concludes.