Mkpoikana Udoma

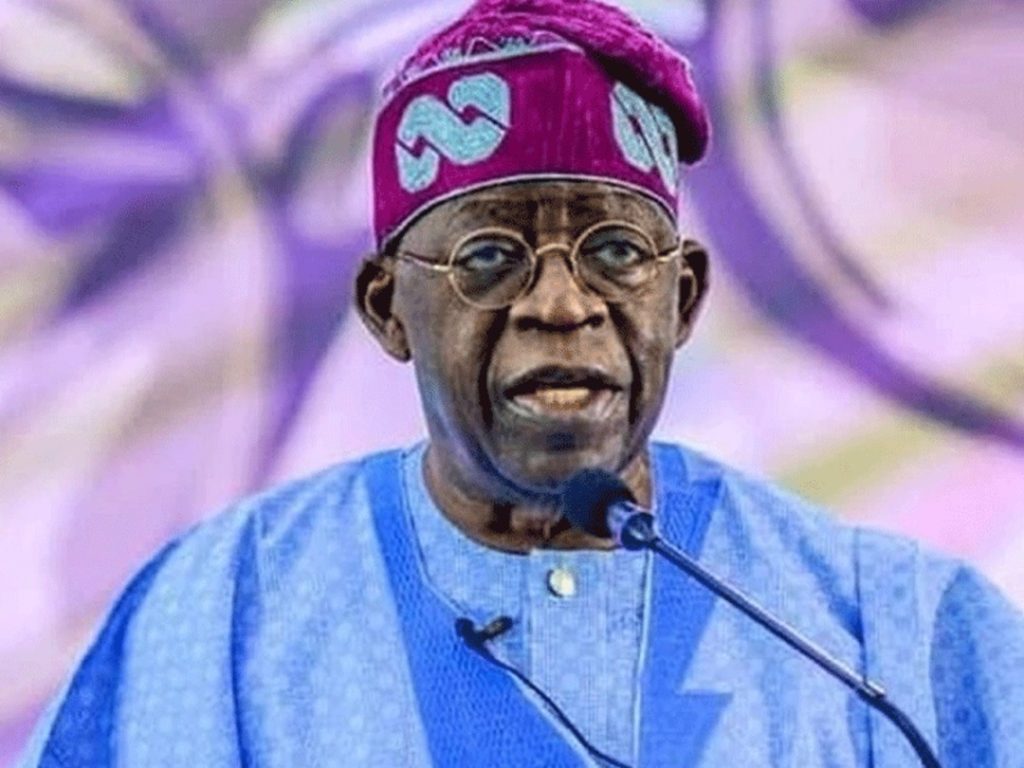

Port Harcourt — The President Bola Ahmed Tinubu-led government is facing growing scrutiny over its commitment to Nigeria’s economic revitalization, as the cost of the prolonged closure of the Aluminium Smelter Company of Nigeria, ALSCON, in Ikot Abasi, Akwa Ibom State, has soared to N13.67 trillion ($8.54billion), according to expert estimates.

Speaking during a recent brainstorming session of the Expert Council for Regional Economic Development in Uyo, Akwa Ibom State capital, Mr. Friday Udoh, Director of Emerging Knowledge, Policy and Partnership at the Institute of Professional Economists and Policy Management, described the continued closure of ALSCON as “an absolutely unbelievable assault on Nigeria’s economy and sovereignty.”

Udoh, a former management team member of Ferrostaal AG (the turnkey contractor and developer of ALSCON), said the plant’s inactivity, factoring in direct losses and lost value-added activities, has dealt a severe blow to the manufacturing sector, downstream industries, and the national economy.

“UC Rusal’s continued access to ALSCON is illegal,” he declared, citing three Supreme Court rulings that voided the company’s ownership.

He stressed that the situation has placed over 11,000 jobs at risk and questioned why the Tinubu administration continues to negotiate with a firm that “ruined the economy.”

“The political will of Mr. President is what is needed to act and implement the Supreme Court judgment to the letter. Why should the Federal Government negotiate with a company that destroyed economic value? The closure of ALSCON has already crippled the country’s capacity to add value to our abundant natural gas reserves.”

ALSCON, valued at $3.2 billion, was awarded in 2004 to Nigerian-American firm BFI Group as the preferred bidder by the National Council on Privatisation, NCP. However, the President Olusegun Obasanjo-led administration reversed the decision in favor of UC Rusal, acting through a Special Purpose Vehicle, Dayson Holding Limited, a firm registered in the Virgin Islands.

Although the Supreme Court in 2012 ruled in favor of BFI Group, affirming it as the rightful owner, the government has yet to enforce the ruling.

“The same forces that undermined BFI Group’s bid are still very active within successive governments, including the present one,” Udoh warned.

In January 2025, the Minister of Steel Development, Shuaibu Abubakar Audu, during an inspection tour of ALSCON, pledged to resolve ownership issues, gas supply challenges, and the dredging of the Imo River. But Udoh dismissed these as distractions.

“These are not the real issues. The real issue is that UC Rusal or its agents have no legal stake in ALSCON,” he said.

Aluminium, he explained, is essential to modern economies due to its wide applications in automobiles, aircraft, buildings, and electronics. “We strongly believe the President can turn the economy around, but he must avoid the mistakes of past administrations,” Udoh added.

He recalled that in 1997, Voest Alpine Industrial Services submitted a proposal to refurbish ALSCON at a cost of N42 billion ($490 million). Today, he said, it would cost more than 200% of that amount to restore the plant.

“This is similar to what happened with the Ajaokuta Steel Plant. Nigeria paid ArcelorMittal’s Global Steel Holdings N199.81 billion ($446 million) in arbitration settlement due to breach of agreement. The same scenario is playing out with ALSCON.”

Experts say the plant could significantly boost Nigeria’s GDP, regional employment, and national exports. “ALSCON’s operations could generate as much as N5.71 trillion ($3.564 billion) annually,” Udoh noted.

Udoh also condemned the 2014 London Court of International Arbitration, LCIA, award favouring Dayson Holdings, labeling it “fraudulently procured.” He cited the intervention of Barrister Lois Ikongbeh, a former government legal counsel, who contested the authenticity of the arbitration, leading to Dayson’s quiet withdrawal of its initial suit and re-filing for enforcement at the Federal High Court, Abuja in 2019.

According to the LCIA ruling, Dayson was affirmed as legal owner of ALSCON shares, with BPE ordered to pay legal and arbitration fees totaling over €600,000. However, Udoh insists this decision contradicts the Supreme Court judgment and is void.

“The arbitral panel ignored the fact that the Share Purchase Agreement was signed while litigation was ongoing, making it null and void. The tribunal remained willfully blind to the facts as long as BPE provided sworn declarations.”

He warned that Nigeria’s position in the global aluminium value chain has become “precariously import-dependent,” adding, “We have lost not just jobs and income, but massive productivity by failing to add value to our gas and natural resources.”