Lagos — There is a delicate blend of optimism and caution as oil supermajors sail into earnings season, following one of the worst years for the industry.

According to the research data analyzed and published by Sijoitusrahastot, the energy sector was the worst performer on the S&P 500 in 2020, plummeting 37% YoY. Comparatively, the broader index had a close to 15% gain during the period.

ExxonMobil, the largest US energy firm, was one of the stock market’s top losers in 2020. Its share price fell by a massive 40% during the period. The decline wiped around $120 billion from its market value.

Exxon Reports First Annual Loss in 40 Years

At its peak in 2007, Exxon had a market cap of $525 billion. As of February 2, 2021, it was down to $189.59 billion according to Marketwatch. Other oil giants were not spared either.

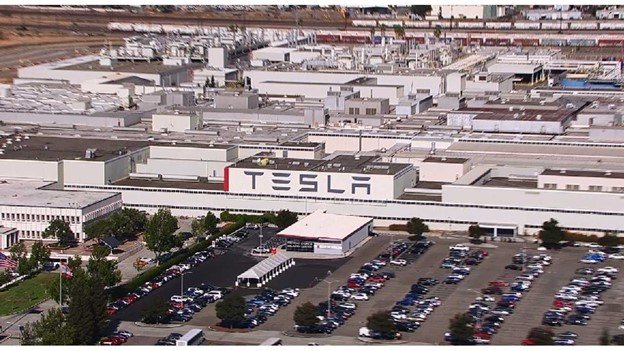

Chevron lost $68 billion in market cap during the year. It was valued at $164.01 billion as of February 2, 2021. At the same time, BP had a market cap of $75.25 billion, Royal Dutch Shell $139.67 billion and Total SE $111.44 billion. The five had a cumulative value of $680, about $70 billion lower than Tesla’s $752 billion.

Exxon posted a loss of $20.1 billion in Q4 2020, its fourth consecutive quarterly loss. Its revenue amounted to $46.54 billion, against an expected $48.76 billion according to The Street. For the full year, it had a loss of $22.4 billion, its first annual loss in 40 years.

Chevron had a loss of $11 million in Q4 2020 compared to a $2.8 billion profit in Q4 2019. Overall, it had a $5.54 billion loss for the year, compared to the 2019 profit of $2.92 billion.