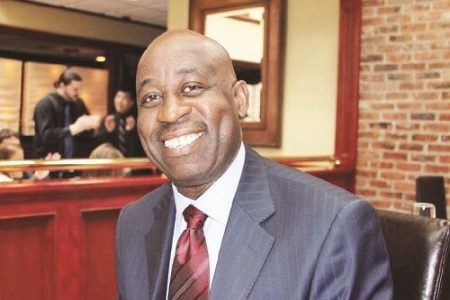

31 January 2012, Sweetcrude, ABUJA – Managing Director and Chief Executive Officer of Nigerian Electricity Liabilities Management Company (NELMCO), Dr. Sam Agbogun, says the Power Holding Company of Nigeria (PHCN) is oweing various organisations in Nigeria and outside the country about N340 billion.

31 January 2012, Sweetcrude, ABUJA – Managing Director and Chief Executive Officer of Nigerian Electricity Liabilities Management Company (NELMCO), Dr. Sam Agbogun, says the Power Holding Company of Nigeria (PHCN) is oweing various organisations in Nigeria and outside the country about N340 billion.

Agbogun told news men, Monday, in Abuja that part of the debt was carried over from the era of the defunct National Electric Power Authority (NEPA), outlining the debt profile to include borrowed funds from multilateral agencies, unpaid charges for gas supply, unsettled medical bills and unremitted withholding taxes and Value Added Tax (VAT).

According to him, PHCN creditors include the World Bank, which is being owed loans for construction of infrastructures, Federal Inland Revenue Services (FIRS) and many other government agencies as well as oil companies involved in gas supply and other suppliers.

“These liabilities emanated from gaps in the on-reflective tariff regime of the sector, debts to PHCN suppliers, medical services rendered, withholding taxes and VAT to the FIRS, as well as gas purchased by the utility but was not paid for because over the years it was like gas was being given to PHCN free of charge,” Agbogun said.

But besides these debts, he said NEPA/PHCN had, over time, through the non-existence of a cost reflective tariff regime in the sector incurred heavy debts through non-payments for support services rendered to it.

He said PHCN creditors have been invited by his company to tender credible documents for due diligence.

Agbogun said: “We are directly responsible for settling the over N340 billion liability of PHCN and as it stands, government will have to find a way to pay off the debt but how soon that will be, I cannot guarantee because it may take well over five years or more to clear.

Some of the options available in offsetting the liabilities include utilisation of some proceeds from the sales of PHCN assets not directly related to power generation, transmission and distribution, and sale of government bonds and treasury bills in the capital market.

Agbogun also disclosed that the total annual payable pension of PHCN’s pensioners has risen to about N10.8 billion.

He said that the calculated figure for the over 11,000 pensioners per month is between N850 million to N900 million, translating into N10.8 billion per year, adding that its possibility of increasing further was very open considering the rate of retirement at PHCN.

He stated: “We are supposed to equally manage the pension administration of the PHCN which has risen from N680 million to between N850 to N900 million per month as a result of the rate of retirement and wage increase recently effected by the government for workers of the utility.

“The total annual pension of the workers is now N10.8 billion for about 11,000 pensioners. If the workers retire now before the final sale of the PHCN, they will come into the purview of NELMCO in pension administration but if not, they will not.”